Reader's Choice

Popular articles

Sberbank of Russia may well be called a mortgage bank. Mortgage conditions in Sberbank are not burdensome: the young family of two working to pay off the debt is quite capable, and immediately after the wedding you can enter your apartment. Sberbank mortgage is also available to older people, just to repay a loan up to 75 years, that is, say, 55 mortgages for 30 years will not be given, only 20.

Due to favorable conditions for mortgage lending, Sberbank firmly holds the first place among Russian banks, and negative customer reviews are only markedly inadequate. Bank employees themselves joke: “We are the first in the first rating unit on mortgages.”

Mortgage from other types of housing loans is different in that the pledge as such is not necessary. Mortgage property is purchased housing. If, for example, a careless client has gone bankrupt, he will, of course, have to move out of the apartment, but he will not fall into debt bondage forever. The bank will return its money by selling the vacant apartment on the secondary market, well, plus the interest received from the already paid.

Such a loan scheme allows us to live well by ourselves and provide easy conditions for clients, but only with very wide promotion and actively developing housing construction. And I must say, in Sberbank, having inherited a wider circle of clientele from the USSR, they did not blunder. Well, what kind of housing problems we inherited from the past is not worth repeating.

Compared to other banks, it is easy to get a Sberbank loan for housing, but first of all you need to decide: which mortgage, for example, will be more suitable for me? The difference in terms is interest, but with a large total amount, the percentages for the money will cost a lot. For their money, which, anyway, you need to earn and give. So what can I expect?

Note 3: 20 years of maximum military mortgage are determined by the maximum service life under the contract. If, say, a contract for 5 years, then they will also give a mortgage for no more than 5 years. Accordingly, the annual percentage will increase.

For all credit programs, the annuity payment system, i.e. in equal parts by month. You can’t expect a reduction in the monthly installment as you pay off, as in some consumer loans, because under such light conditions the SC cannot afford to refuse the annuity. Penalties for late payment - 0.5% for each day, including the date of actual payment.

Everywhere, where the annual percentage is indicated, it is necessary to understand “from such and such”. Any bank by law has the right to appoint a larger percentage if it is not sure about the reliability of the client. In arbitrariness about this, the Security Council is not seen; oriented strictly according to the credit bureaus. They can be knocked down, if, for example, once I earned a little and something is overdue somewhere, and the current certificate of income is good.

Hidden commissions in the Security Council is not practiced, the loan is completely transparent. Of compulsory insurance - only fire on the purchased housing. You can voluntarily insure property and life, and this insurance is really voluntary: getting a loan and the assigned amount of the interest rate do not depend on it. Do not want - your business.

It is possible to repay a mortgage in Sberbank ahead of schedule if you have already made at least 3 monthly payments. For early mortgage SB does not penalize.

The initial installment can be made maternal capital. With a strong stable state support, the Security Council reads this willingly, if only the CII and the income statement do not “hack” the mortgage at all. Since the size of the MK has already exceeded 400,000 rubles, and it is possible to buy a quite decent secondary two-three-piece for 3,000,000, this is a very substantial benefit.

If the amount of MK exceeds the calculated amount of the initial payment, then the balance goes to repay the debt body; accordingly, with the same percentage, the amount of the mandatory monthly payment decreases. But to give, say, half of MK to the bank, and the rest cannot be postponed or spent in any other way.

On mortgage Sberbank allows refinancing. What does it mean? Suppose I pay accurately for 5 years. Meanwhile, the cadastral value of my apartment has increased by 10%, and I took 4 million. I go to the bank, I say: "I want refinancing." The procedure is rather dreary, and we need to talk about it separately, but as a result, 400,000 are added to my loan body, and now I need to pay the balance from 4.4 million.

And why do I need these extra 400 000 debt? And I buy them a car on credit. And I will pay for it not the consumer interest, but the same mortgage, which is twice or more lower. A kind of bonus from the bank to bona fide and farsighted customers.

As already mentioned, the interest on the mortgage is considered "from". By the way, the initial payment is "from" does not apply; that cash is paid, it is not subject to requisitions. But "from" the Security Council is also not keen. They can count on the minimum percentage:

The last point requires clarification. Suppose I have a rich uncle who is sure of me, knows that I will certainly give a loan from my own. He writes and registers with the notary a statement of guarantee, I attach it to the primary set of documents (see below) - everything, my mortgage, and at a minimum. Another option - a grandmother in the village. Poor, but with a plot of land suitable for economic use. She will entrust for me, will give her land as a pledge - again, all problems are solved.

But the opposite is also possible, when a mortgage is given, if it is, then by an increased percentage. In addition to past inconsistencies in the BKI, these are factors testifying to the unreliability of the client: frequent (more often than once a year) change of place of work with qualifications and experience, the same frequent reprofiling in small business, civil marriage for more than 3 years without children, etc. P. Southerners are especially disliked in the Security Council: if after 30 have not yet married and rush from work to work, it is better not to count on a mortgage.

Note 5: but a problem family can get a mortgage. If the marriage is officially registered, there are children and there will be a guarantor - a social service or a private charitable foundation.

Now let's look at the main thing: can I afford a mortgage? Suppose I am a loner, there is a girl, but you can’t count on her: she sits in the office, gets how she works. How much do I need to earn to arrange our lives with the help of a mortgage? Let's estimate.

Counting on a future child for 10 years, there will be enough two-room apartment with an unpretentious situation; there unleash, not hastily done. Total - it is necessary somewhere 4-5 million. We are two less than 60, so they will give for 30 years. The year will have 140,000-180,000 payments, and a month from 11,700 to 15,000. For 15,000, we will live with the child together, pulling up a belt, and a girlfriend gets 9,000. That is, if my salary is from 20,000, then I take a mortgage can.

But you still need to collect a down payment, from 400 to 600 thousand. This is 20, or even 30 months of my current work, for 20,000. Others have no sense in re-crediting to the first principle: if there is another very heavy credit hanging on me, I just won't be given a mortgage . There are actually only two ways out of the situation:

Federal SSC intends to promote lower rates more: by 2018 it is planned to reduce the mortgage rate to an inflation rate of + 2.2%. According to Shuvalov, this unprecedented level is possible due to high liquidity of housing. It seems that the problem of the first installment is close to resolution.

So, moving to your apartment after the wedding is possible for an ordinary citizen who has reached 21 years. From 18 to 21 - alas! Physical and civic maturity are different concepts. Then the question arises: how to take a mortgage in a savings bank? Where to go, to whom, with what papers? And how not to fall into the hands of crooks - probably because they are eyeing such a tasty morsel?

Tip: It is better to entrust the execution of housing documents to specialists. Their turnover is large, so prices are divine. And in state institutions mortgage holders - the queue. If you have overdue with the papers - not only the mortgage is burned, but the credit history also deteriorates. And again - just having conceived a mortgage, try to find a vendor providing documentation. Its cost can then be included in the loan, and in the monthly payments its share will not be visible.

Practice shows that the optimal sequence of actions does not quite coincide with the recommended bank on its official website. The point is this: after approval of the application, the bank gives 3 months to search for the property and prepare documentation for it. For an inexperienced person, these efforts are complete hell. Easier and easier this way:

So, we are preparing documents for a mortgage in Sberbank. There is a caveat here: if you work for an entrepreneur, you need to take it in the bank, Sberbank, an income certificate form, and have a host on it in order to fill it correctly in the last 6 months and attach a stamp. He will also need your employment contract certified by the municipality. This together will replace 2-NDFL, see the list.

An unpleasant moment comes up here: they will give a mortgage only if the payment of the next monthly installment for each adult family member leaves no less than the minimum wage. That is, if I, for example, get paid a “black” mortgage, I cannot see my ears without a mirror, even if I drove up to the bank on the new Aston-Martin. The "muddy" owner, of course, does not want to "shine" before the tax.

But let's say I have everything “white.” Then we need the following papers:

The last point is very slippery. If you take the secondary, stock up a copy of this paper before your first visit to the bank; it does not bind owners to anything. What if at the last moment they go back down - and you will not get a mortgage, and KI will spoil. You, not them.

Suppose a bank is happy - they give us a mortgage. Now you need to prepare documents for housing. As already mentioned, it is better to entrust this to a real estate agency registered with Sberbank. Generally speaking, they will accept the package and not from their own, but theirs, as they say, have a good track, it will go faster and cheaper. Do not forget, time is limited: 3 months, or the mortgage has burned.

Advice: in the provinces, most often you just need to ask at the bank - and which agency in the vicinity would they recommend? Then there will be no problems.

In the bank for the final registration, you can go, having on hand the following:

Note 9: it is generally accepted that the power of attorney in this case is issued by the seller at his own expense in advance. If you require payment from you - this is a sign of an irresponsible seller or swindler.

There is a mortgage "Young Family" in Sberbank. The conditions are the lightest possible: 10% initially, 10% per annum, the mother's capital will be accepted as a down payment, even if it is a bit lacking. Young is considered a family in which one of the spouses at the time of application has not yet turned 35.

As a privilege, a property tax deduction is given at a time and tax is permanent for the entire loan period. But the highlight of the "Young Family" is that you can attract a co-borrower - a spouse. For two employees, this is a huge relief and a high chance of getting a loan. In banking practice, a joint loan is found as an exception for especially trusted reliable customers. Co-borrowers can attract parents, according to documents certifying the relationship: marriage certificate (them) and birth (your). But in the "Young Family" there are nuances.

First, 10% of the initial give to families with children. If the loan is collateralized, then the cost of the cadastral (non-market) valuation must be at least 90% or 85% of the total loan amount, respectively.

Secondly, preference is given to young families of two working with children. Since there is a queue in the “Sberbank” for a young mortgage, childless it is better to get loans “in an adult way”.

Thirdly, with a large difference in age, the restriction on payments up to 75 years comes into force. That is, if a 25-year-old married a 50-year-old, and there is a child, her own, from a previous marriage or “fattened up”, then the maximum loan repayment period will be no more than 25 years.

And finally - a pleasant nuance. Incomplete families (mother or single father) may be credited “as young as they are” regardless of the child’s origin or previous marriage (s). And if the child is an adopted orphan, then they will certainly give a mortgage, if only income would allow or there was a pledge.

For many, due to housing problems, the thought arises: isn’t it going to be pulled to the West? There you can take a mortgage at 4% per annum. That’s the way it is, and the heifer over the sea is half a ruble, and the ruble will be counted without transportation.

Take, for example, a country with almost the cheapest real estate - Spain. Yes, there are 3-4% per annum on mortgages, and in the southern resorts a square of housing goes for 2,000 or even 1,000 euros.

But this is not from a good life: they, not foreseeing the global crisis, have re-settled, and now about 800,000 (!) Households are put up for sale according to state programs. Accordingly, hidden fees are more than enough. And only natives can count on social benefits.

Say, for housing of any area you need to pay state tax on real estate, 2% of the cadastral valuation, which is completely unrealistic relative to the actual market value. In a big way. And the municipalities use any legislative loopholes for extortion in their favor. As a result, the amount of the monthly payment for visitors, even those who received citizenship, turns out to be very heavy compared to the available salary.

Many people want to have their own housing, but as a rule most live either with their parents or in a rented apartment. This brings a lot of inconvenience and the desire to own your property only increases. There are two ways out of this situation: either to save money for an apartment for a long time, or to use a mortgage. In this article I would like to tell you how to get a mortgage on an apartment, based on personal experience. I hope my story will help you decide whether to cost to do it.

Is it possible for a young citizen of Russia to buy their housing?

Before starting to talk about how I took a mortgage on an apartment, I will analyze a little the situation in the real estate market. This is necessary in order to reveal the possibility of buying an apartment to a young citizen of our “wonderful” country) ...

I will take the example of the real estate market of the city of Voronezh, because A year ago, he took a one-room apartment in this city and analyzed the prices on the market before buying.

So, the average price for a 1st apartment of 35 square meters is about 1,700,000 rubles. Moreover, most developers are doing a rough finish, but it is still possible to add at least 100,000 rubles for repairs. As a result, we get 1 800 000 rubles.

Now attention question) Where to get such a large amount? The answer is simple - from nowhere.

The average salary in Voronezh is 18,000 rubles. From this amount we deduct expenses of a different type for a month. And there are about 8,000 thousand. Very small amount. And if you consider how young people like to spend money on everything that is necessary and unnecessary, then as a result, by the end of the month, it remains zero. Just a bare zero))) ... As a result, it turns out that you will save money for an apartment oh how much. By old age can and save) ...

My husband is saving up for an apartment: he has already saved up a lot - soon I will buy a fur coat.

Based on this, it can be concluded that it is impossible for one person to buy their housing with such a salary. The same picture is obtained with the acquisition of housing in the provinces and in our cities. The ratio of the cost of housing and wages is simply terrifying.

I can write only such words. Thank you dear beloved country, that you help me ...

I want my accommodation, but I can't do it. Housing - expensive, wages - low. So we live in Russia, gentlemen! And we will live in this “ass” for a long time ...

And everyone wants their housing! What to do???

And here our favorite state offers to take housing in the mortgage.

Why I decided to take housing in the mortgage ...

It so happened that the mother’s relationship with the man ended and she returned. In Borisoglebsk, where I now live and work, we have a couple. Naturally, living with your mother a young man at 24 years old is “right”. Everyone should have their own space.

After negotiations at the “family council,” we decided to take an apartment in a mortgage and disperse. Naturally, we calculated our income and the ability to pay the mortgage. Taking a mortgage loan is a very important matter. And first you need to thoroughly move your brains ...

My situation is so sad because I already have an apartment in Voronezh. It turns out that we risk nothing. If in life there are some kind of "force majeure", then one of the apartments goes on sale and the money on the mortgage is paid.

Advice: carefully calculate your income and foresee the risks before getting into the mortgage) ...

So in this case, I advise you to use the mortgage calculator to see the amount of payments per month.

I personally liked this mortgage calculator. It is possible to enter all the necessary initial data. At the exit detailed information on monthly payments and the amount of overpayment on the mortgage.

1 unique personality development system

3 important questions for awareness

7 spheres to create a harmonious life

Secret bonus for readers

7,259 people have already downloaded

Entering my apartment data, I received 13, 500 rubles a month. Pull together with my mother this amount we can. Those. it turns out that we are creditworthy.

- Where, man, do you shame without shame?I can not let you naked in the bank!

- I beg your pardon, ladies and gentlemen!I pay a mortgage fee!

What is a mortgage and mortgage loan?

Mortgage - This is one of the forms of collateral in which the pledged real estate remains in the property of the debtor, and the creditor, in the event that the latter fails to fulfill its obligation, acquires the right to be satisfied by selling this property.

If in simple words, the mortgage is a pledge.

The concept of mortgage and mortgage loan is different.

Mortgage - one of the components of the mortgage system. This is a loan that is issued by the bank on the security of real estate.

At the same time, it is necessary to know that a mortgage loan can be issued on the security of both already existing real estate and on the security of the acquired property.

In fact, a mortgage loan is not much different from non-mortgage. Since, in the first case, the amount of the home loan is large, the bank needs guarantees for the repayment of the loan, and these guarantees are real estate taken as collateral.

In general, you can write a whole book about a mortgage, but I don’t have such a goal). Then I will tell you in stages how the purchase of an apartment on a mortgage took place and talk about all the pros, cons, advantages and pitfalls of mortgage lending.

It is worth mentioning that there are various mortgage programs that provide different conditions. The most common of them is a regular mortgage loan for one person, a mortgage for a young family and a mortgage for military personnel.

So I was interested in the usual mortgage lending, because I do not have a young family and I do not serve the Fatherland))) ...

Stage 1. Search for an apartment.

We searched for the apartment in various ways: notice boards on the Internet, announcements in the newspaper, agencies, through acquaintances. As a result, my mother found the apartment through the Tatyana real estate agency. It was a one-room apartment worth 1,100,000 rubles.

She had a lot of advantages:

- improved layout (34 sq. M)

- dormitory area

- second floor, loggia

- 2 minutes to mom's work.

I was at lunch. Mom called and said that we need to take time off from work, let's go to the bank. I realized that she found an apartment for herself "to her liking." In the evening she told me everything, I agreed with her. The option was excellent.

Stage 2. Application for a mortgage loan

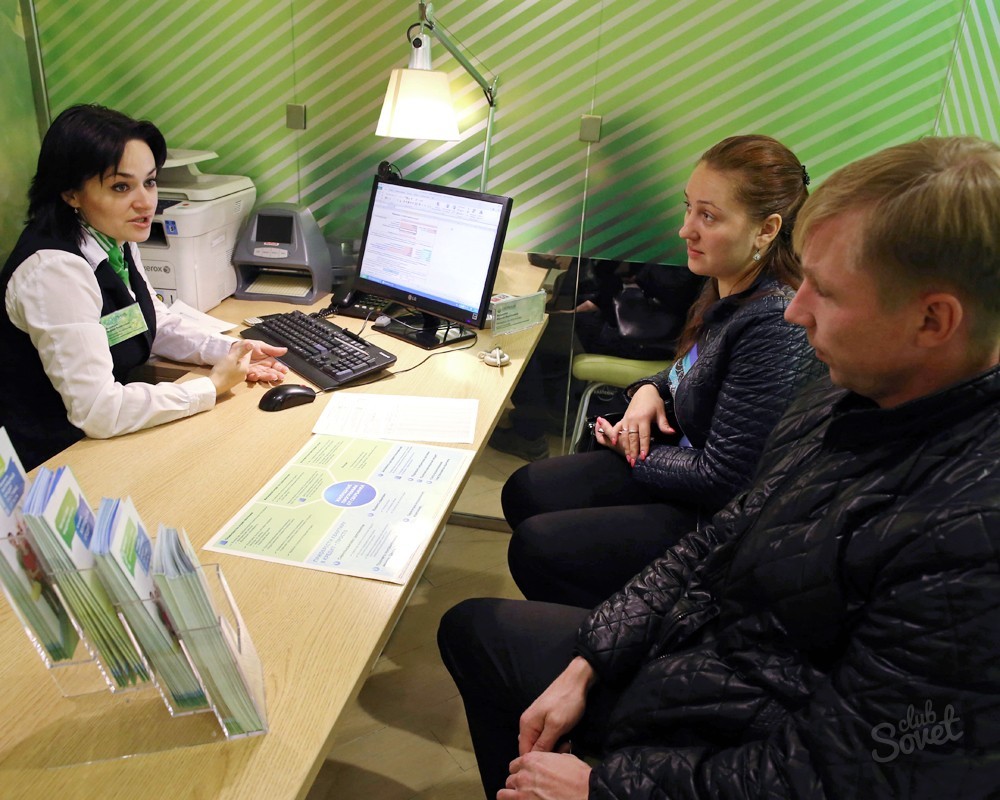

In the morning we went to make an application to Sberbank. I did not want to take a mortgage in other banks. In principle, all large banks offer similar conditions, so it’s not worth digging into them for 1% in a mortgage. Again, this is my personal opinion.

To serve us has become a young girl. Her name was Valentina. She told us a little about the mortgage. We decided to take a mortgage for 10 years with a 15% down payment.

I will pay special attention to these indicators.

The less time to pay the mortgage and the more the initial payment of the cost of the apartment, the less overpay!

We decided that I would be a borrower, and my mother - a co-borrower. For some reason, I had the notion that if the income is greater, then the amount of the mortgage loan will be greater, but not at that.

In the application you must specify your income. Also a very important point.

You can provide NDFL-2 for the past six months, or you can, if you have a Sberbank debit card, look at the income of a person. Still asking extra income. I said that I rent an apartment in Voronezh. As a result, my monthly income was more than 30,000 rubles, and my mother’s was about 20,000 rubles.

Tip: say any other income in any amount, no one checks this information.

The application was processed for about a day. The result was disappointing - only more than 800,000 rubles, and we needed 935,000.

Then Valentina said that I would have good data without a co-borrower. We rewrote the application without a mother and sent for processing. As a result, they gave me a mortgage loan in the amount of 1,053,000 rubles. This is how it happens) ...

I was honestly shocked. It turns out that not the entire income is considered, but the average value of the income of 2 people. Those. There is a sophisticated coefficient in the calculation.

But in the end, the amount suited us. All was good.

Stage 3. Working with the agency and collecting all the necessary documents for the mortgage.

The longest stage. Tatiana from the real estate agency helped us collect all the documents.

Tip: Better the entire procedure for working with real estate trust professionals. You will spend more time and nerves.

Mortgage requires an estimated value of the apartment. It was made in 4 days. For the work they took 6,000 rubles. Just made a preliminary contract of sale. Immediately gave the seller a deposit of 15% of the value of the apartment. From 1,100,000 it was 165,000 rubles. This is indicated in the contract itself.

Those. it turned out that the deposit was equal to the initial payment required for the apartment in the mortgage.

He also went and took a certificate from a notary that I was not married. The cost of 600 rubles.

The whole procedure took about a week.

After all the documents are collected, they must be taken to the bank. Further, these documents are reviewed by legal professionals and approved by bank underwriters. It takes about a week. Our documents were confirmed in 3 days.

Stage 4. Bank and state certificate of ownership.

After approval, the bank issues a mortgage loan, and all finished documents are given for state registration.

And here the bank needs to “suck out” money from a person. In another way, I can not call it.

The bank, like a mortgage you approved, and gives the money, but that they were whole and not gone away before giving the rights of state ownership of the apartment, you have to lay them in a bank cell. And for this you need to pay)))) And pay well - 2 400 rubles. There was also an incomprehensible receipt for 1,400 and insurance for about 1% of the value of the mortgage. And this is more than 9,000 rubles.

As a result, they gave me a piece of paper in the form of a certificate for 935,000 rubles, and we went to the bank with the seller. It was somewhere in the basement behind a huge door. We put the certificate in this very cell. Lie dear to our parish))). This bank cell opens with two keys. One was with a bank employee, and the other was given to me. Scratch it was impossible, otherwise forgive all the money)

And only after the state. registration this certificate should be given to the seller. And then the seller can do with him everything he wants.

Stage 5. Final

So, a week later we were invited to take all the documents of state registration. We went to the bank with them and went back to the cell for the certificate.

As a result, the certificate was given to the seller, and to me - the keys to the apartment.

Joy knew no bounds! Everything went without any excesses and without any special nerves.

It all took about less than a month. I think this is a normal time frame.

My opinion about the mortgage ...

As a result, while I was going through the whole process, I gave about another 25,000 thousand rubles.

Part of this amount is really approved (appraisal of the apartment, the work of a realtor). But here's what the bank is ripping off people and shaking money from them for any “nonsense” such as a bank cell, insurance and other receipts, I was offended. So a person will pay interest, and rather big ones. And then pay. In general obderalovo. No other words.

And another moment that infuriated me. These monthly payments.

At the beginning, a large amount of debt on a loan goes to pay interest, and only a small amount goes to pay off the loan itself. The figure is clearly visible. Those. the bank does not allow people to pay the mortgage faster. From the first month is already starting to take money for interest.

But here you can remember one expression. Do you like to ride - love and sleigh to haul.

If you want - take a mortgage, but do not want it - do not take it. Nobody makes you.

Those. as a result, we can conclude. Everything goes to the exhaustion of money from a person who already does not have them. And the state, and banks contribute to this.

And what to do when you want your accommodation, but there is no money? Take a mortgage.

In principle, if you count, then over 10 years I overpay 700,000 rubles. If you count, it turns out 70 000 rubles per year. If you look from this side, then the annual amount of interest is not so big.

My opinion is that if you don’t have a home, then it’s better to take a mortgage and pay for your apartment than to wander through incomprehensible removable and pay in principle the same money.

I can say that taking a mortgage is easy. For the first time, of course, there is a lot of confusion and misunderstanding, but you can deal with everything.

So think and take, and I will pay further. I think that I will pay much faster, 10 years to drag on for a long time))) ...

I think that my story will help you decide whether to take a mortgage loan.

Regards, NikSy!

In 2017, the financial institution reduced interest rates for housing lending three times, the last change was at the beginning of August of the current year. Now provided the most favorable mortgage terms in Sberbank, on its website, the bank offers to calculate online the full cost of a loan to purchase a home using the provided mortgage calculator.

The purpose of mortgage lending is the purchase of real estate for borrowed funds. This kind of borrowing involves signing:

Banking policy in the field of housing loans to citizens is aimed at providing individuals with available borrowed funds, simplifying the paperwork procedure. Borrowers from other financial institutions can apply for a mortgage at Sberbank on more favorable terms - refinancing (refinancing) of already existing ruble and foreign currency housing loans.

The August changes to the conditions for a mortgage in Sberbank provided additional benefits to borrowers:

Important positive features of banking products in the current year are the following conditions for obtaining a mortgage in Sberbank:

Among the advantages of a mortgage financial institution in 2017 are the following points:

Expect to purchase housing under the program Young family can individuals, provided that one of the spouses is younger than 35 years. For such borrowers, the provision of a loan for the purchase of real estate is possible at an annual interest rate of 9% when providing a salary certificate or 10% - in the absence of confirmation of official income.

The bank has a special program that provides loans to public sector employees - young scientists and teachers. State support is provided for them by financing part of the cost of housing. The borrower is issued a state housing certificate and after the bank opens an account in his name when making a social mortgage, funds are transferred from the federal budget.

An application for a mortgage loan is possible at the Sberbank branch. Applying an application online will be convenient for the client. The decision of the bank about the issuance of loan funds is made for 2-5 days. After the employees of the credit institution are satisfied with the client's solvency and approve the mortgage, the borrower receives a message on the mobile phone.

You can take a mortgage to citizens of the Russian Federation who have permanent registration at the place of residence. The borrower must be over 21 years old. Retirees can get a housing loan. For them, the maturity of the loan can be reduced, since on the day of the end of the mortgage contract the age of the borrower should not exceed 75 years. The age limit of the borrower is reduced to 65 years in the absence of confirmation of official income.

When making a loan for the purchase of residential real estate, the borrower must have at least six months of work experience in the current workplace. Over the past five years, his total experience must be at least 1 year. Requirements for having a general experience do not apply to payroll clients - working citizens and retirees who receive payments to a bank account.

Sberbank issues a mortgage loan at favorable interest rates and wants to receive guarantees of the return of borrowed funds, therefore, it places high demands on the client’s solvency. The borrower at the time of signing the loan agreement should have a stable income, and the calculated amount of monthly payments should not exceed 50% of his salary.

A testament to the reliability and solvency of a client is its flawless credit history. To approve a loan application, all previous customer borrowings are checked. If the service finds a violation by the borrower of the payment schedule or cases of incomplete payment of the next installment, a housing loan may be refused.

To consider an application for a housing loan, along with the questionnaire it is necessary to provide the bank with a package of documents:

In the absence of confirmation of official income, you can submit one of the documents:

When attracting a co-borrower to obtain a mortgage loan, you must show his passport and income statement. When applying for a loan under the Young Family program, an additional certificate is issued on marriage and the birth of a child. After approval of the application, documents on the credited property are submitted to the bank and a down payment is made.

Clients of a credit institution can register for the purchase and sale online without visiting Rosreestr. The borrower must hand over the real estate documents to the bank manager and pay the state duty in the amount of 1,400 rubles. In this way, you can register:

The cost of registration services is within 5550-10250 rubles, it depends on the region of residence of the client and the type of housing. After completion of the procedure, an extract from the Unified State Register of Real Estate is received by e-mail of the new property owner. Mortgage conditions in Sberbank provide for those who register online property rights to reduce the base interest rate of 0.1%.

The activity of a financial institution is aimed at developing mortgage programs for a specific client - its requests and capabilities. Borrowers can view the housing loan offers on the bank’s website. To select the optimal lending option, a Sberbank loan calculator is provided. With it, you can calculate the maximum loan size with available income, get an approximate schedule of loan repayment.

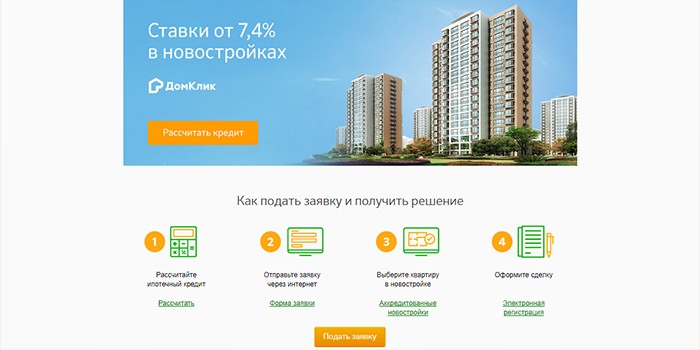

For this type of lending, you can borrow money to buy finished housing in a new building or buy property during the construction phase. Clients can pick up housing in the House Click section, where developers offer apartments in 127 residential complexes. Mortgage conditions in Sberbank for the purchase of an apartment in a new building are as follows:

For such borrowing, the borrower is offered a base interest rate of 9.5%. In the absence of confirmation of official income, the basic conditions do not change. The exception concerns the interest rate - it is 10.5% and the down payment - its size should not be less than 50%. From August 10, 2017 there are minimum rates for housing loans when buying an apartment from a seller company, which compensates the borrower for a part of interest.

Under the terms of the Promotion, a low interest rate of 7.5% can be obtained from the developer by providing a certified salary certificate and 8.5% in case of its absence. Minimum rates are valid for 7 years. There is a possibility of obtaining borrowed funds in two parts.The first part of the money is issued after the registration of equity participation in construction, and the second is transferred before the expiration of 24 months after the first tranche and before signing the deed of transfer.

For this type of lending you can buy resale housing. For registration of a pledge of residential property, you can use the acquired apartment or an existing property. Under the terms of the mortgage in Sberbank, borrowed funds are issued:

When borrowing for the purchase of housing in the secondary market, the down payment begins with 15% of the value of real estate and is not less than 50% in the absence of confirmation of the official income of the borrower. The interest rate for the provision of certified salary certificate is 9.5%, otherwise it is 10.5% per annum.

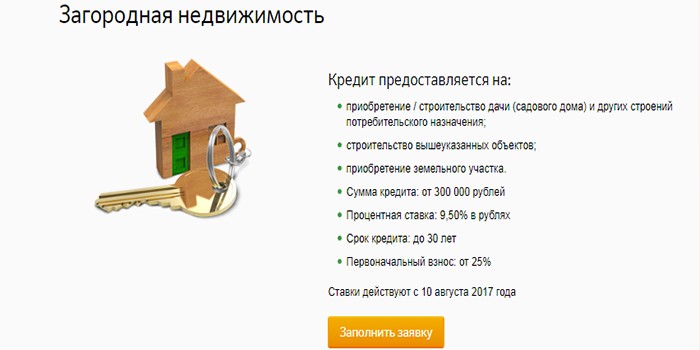

Special mortgage product is provided for the purchase of suburban real estate.Borrowed funds can be used for:

Funds are issued on the following mortgage terms in Sberbank:

Due to the borrowed funds, it is possible to carry out individual housing construction using one’s own resources or with the help of a developer. Money is issued at 10% per annum. Mortgage terms in Sberbank suggest the issuance of funds for the construction of a residential house:

Military personnel can use this type of borrowing to buy an apartment 3 years after the registration and transfer to the register of participants of the savings and mortgage system. Currently, annual transfers from the state budget to the personal account of a serviceman amount to 260,000 rubles. With low housing costs, the borrower can use the accumulated part to make a down payment and to pay off the debt.

In case of insufficient funds, it is necessary to additionally make minor amounts of your own money. Get a loan at 10.9% per annum military personnel can:

When buying a home loan, the borrower can use the funds of the parent capital to repay part of the debt. This will not affect the size of the interest rate. When applying for a loan, borrowers additionally submit a State Certificate for the Maternity Capital and a certificate from the Pension Fund about the balance of funds in the account. After receiving the loan, it is necessary to apply to the Pension Fund with an application for the transfer of funds within 6 months.

![]()

When you make a housing loan indicated base interest rate, which is provided to payroll clients. Mortgage terms in Sberbank suggest a decrease of 0.1% when registering property rights online or an increase in:

Base rates for mortgage products are provided in the table:

| The product's name | Rate upon availability of income certificate (%) | Bid without help (%) |

| New buildings | ||

| Promotion from the developer | ||

| Resellers | ||

| Young Family Program | ||

| country estate | ||

| Individual construction | ||

| Military mortgage |

When signing a housing loan contract, financial institution experts offer to take out life and health insurance, as well as real estate. Its cost can be paid in a single payment at the time of purchase or divided into the entire crediting period and paid monthly, but you will need to pay interest to the bank on the balance amount.

Real estate in the design of the loan comes to the financial institution as a pledge and serves as a guarantee of a refund. The terms of the loan agreement imply compulsory insurance of the property in case of damage or loss. So the financial institution is trying to protect itself from the risk of loss of collateral and non-repayment of borrowed funds.

If you refuse to buy insurance, a financial institution raises the base interest rate by 1% per annum when granting a loan, although life and health insurance is not mandatory. Making insurance can help you lose your job or illness. In such cases, debt repayment obligations are transferred to the insurance company.

Not everyone can afford to buy a house or apartment for cash. Especially, if a young couple is just beginning to live together. To rent a house for rent is not very profitable, prices bite and hit hard. Paying for a communal flat, also for the owner for living, it is not better to immediately take a mortgage and pay it every month. At the same time know that the property will be yours. Consider how to take a loan in the Savings Bank.

Mortgage can take the person who turned 21 years old. It is imperative that at the last enterprise or company you work for six months. It is very good, if the salary card is issued in Sberbank, the bank gives such clients loans first of all. A mortgage loan should be arranged with co-borrowers (husband or wife) or guarantors. If the family takes a mortgage, you must comply with a number of requirements. The age of at least one family member should not be more than 35 years. The husband should already serve in the army or not be liable for military service. This type of mortgage loan is called "Young Family".

It is best to take a mortgage loan in Sberbank. Here, low interest. It is not necessary to insure the health and life of the borrower. The main thing: follow all the requirements of credit transactions, and then you must be given a mortgage loan.

| Related articles: | |

|

Korean carrot grater

Carrots, cooked long ago fell in love with our man. She learned ... Where and how to exchange bitcoin for rubles in Russia

Today, many people who play on cryptocurrency exchanges and engaged in ... Ornaments of the peoples of the world: styles, motifs, patterns

One of the newest fashion trends in the world of nail art - nails decorated with ... | |