Reader's Choice

Popular articles

Electronic cash is a digital cash in electronic form used in network calculations, which is electronic bills in the form of a set of binary codes that exist on a particular carrier, transferred in the form of a digital envelope over the network. Electronic cash technology allows you to pay for goods and services in a virtual economy, transferring information from one computer to another. Electronic cash, like real cash, is anonymous and can be used multiple times, and digital banknote numbers are unique. They can be transferred from one person to another, bypassing the bank, but at the same time retaining within network payment systems. When paying for goods or services, digital money is transferred to the seller, who either transfers it to a participating bank in order to be credited to his account, or pays them with his partners. Currently, various network payment systems are distributed on the Internet.

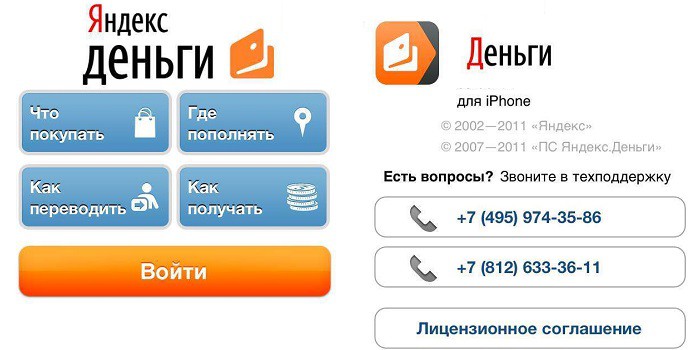

Yandex money. In mid-2002, Paycash entered into an agreement with the largest Yandex search engine on the launch of the Yandex project. Money (universal payment system, created in 2002). The main features of the Yandex payment system. Money:

Electronic transfers between user accounts;

Buy, sell and exchange electronic currencies:

Pay for services (Internet access, cellular communication, hosting, apartment, etc.);

Transfer funds to a credit or debit card.

The commission for transactions is 0.5% for each payment transaction. When withdrawing funds to a bank account or otherwise, the Yandex.Money system withholds 3% of the amount of funds to be withdrawn, in addition, an additional percentage is charged directly by the transfer agent (bank, post office, etc.).

Webmoney Transfer is a payment system that appeared on November 25, 1998, is the most common and reliable Russian electronic payment system for conducting financial transactions in real time, created for users of the Russian-language part of the World Wide Web. Anyone can be a user of the system. The means of calculation in the system are title signs called WebMoney, or abbreviated as WM. All WM are stored in so-called e-wallets.

Payment system WebMoney Transfer allows you to:

To carry out financial transactions and pay for goods (services) on the Internet;

Pay for services of mobile operators, Internet and television providers, pay for subscriptions to mass media;

Exchange WebMoney title units for other electronic currencies at a favorable rate;

Make payments by e-mail, use a mobile phone as a wallet;

Online store owners accept payment for goods on their website.

WM is a global information system for the transfer of property rights, open for free use by everyone. Using WebMoney Transfer, you can make instant transactions related to the transfer of property rights to any online goods and services, create your own web services and network enterprises, conduct operations with other participants, issue and maintain your own tools.

RUpay is a payment system that has been operating since October 7, 2002, is an integrator of payment systems, where payment systems and exchange points are programmatically combined into one system.

Main features of the RUpay payment system:

Making electronic transfers between user accounts;

Buy, sell and exchange electronic currencies with a minimum commission;

Make payments to other electronic payment systems: WebMoney, PayPal, E-gold, etc .;

Accept payments on your site in more than 20 ways;

Receive funds from the account of the system in the nearest ATM;

Manage your account from any computer connected to the Internet.

PayCash is an electronic payment system. It began its work on the Russian market in early 1998 and is positioned primarily as an affordable means of quickly, efficiently and safely conducting cash payments on the Internet.

The main advantage of this payment system is the use of its own unique developments in the field of financial cryptography, highly appreciated by Western experts. Payment system PayCash has a number of prestigious awards and patents, among which is the "Certificate of Special Recognition of the US Congress." At the moment, such well-known payment systems as Yandex operate using PayCash technology. Money (Russia), Cyphermint PayCash (USA), DramCash (Armenia), PayCash (Ukraine). PayCash is based on digital cash technology. From the point of view of the user (seller or buyer), PayCash technology is a set of "electronic wallets", each of which has its own owner. All wallets are connected to a single processing center where information from owners is processed. Thanks to modern technology, users can make transactions with their money without leaving the computer. The technology allows you to transfer digital cash from one wallet to another, store it in an Internet bank, convert it, withdraw it from the system to traditional bank accounts or other payment systems.

PayPal is an electronic payment system, one of the most popular and reliable among foreign payment systems. By early 2006, she served users from 55 countries. The PayPal payment system was founded by Peter Thiel and Max Levchin in 1998 as a private company. PayPal provides its users with the ability to receive and send payments using e-mail or a mobile phone with access to the Internet, but, in addition, users of PayPal payment system have the ability to:

Send Money: transfer any amount from your personal account. At the same time, the recipient of the payment can be either another PayPal user or an outsider;

Execute a request for payment (Money Request). Using this type of service, the user can send letters to his debtors containing a request to make a payment (issue an invoice for payment);

To place on the website special tools for receiving payments (Web Tools). This service is available only to owners of prime accounts and business accounts and is recommended for use by owners of online stores. At the same time, the user can place a button on his website, pressing which the payer enters the website of the payment system, where he can perform the payment procedure (you can use a credit card), and then returns to the user’s website;

Use the tools of the auction trade (Auction Tools). The payment system offers two types of services: 1) automatic payment requests (Automatic Payment Request); 2) the winners of the auction can make payment directly from the website at which the auction is held (Instant Purchase for Auctions).

Hello, dear blog readers site. Electronic money is getting closer into our lives. This is primarily due to the development of the Internet (), which has now become one of the most necessary attributes of our life. Moreover, he had already stepped over that level when we only got knowledge there. Now we live in a network - we communicate, we buy, we sell, we pay for services, we make friends, etc., etc. It is quite logical that in this environment there arise their own systems of mutual payments, allowing them to move away from primitive barter.

It all started a long time ago (mainly at the end of the past and the beginning of this millennium). At that time, monetary relations began to actively develop on the Internet (e-commerce, etc.) and plastic cards were the only available form of payment. The emergence of options for Internet money has significantly simplified the process of payment and receipt of payments.

Now, various e-wallets offer you to use the money on them, not only for any operations inside the Internet, but in real life. For example, a system tied to an account from which it will be possible to pay for your purchases in real life (supermarket, boutique, gas stations and other places where they accept cards for payment). Actually, many payment systems offer similar services.

At the moment, there are several dozen payment systems in Russia alone, and there are even more in the world. Of course, far from all of them are heard, but the very fact that there is competition gives ordinary users of electronic payments certain preferences (all sorts of buns for enticing), which could not be possible if there is no struggle for the client. Of course, within the framework of one article it will not be possible to highlight all the players, but we will certainly consider the most popular ones. At the end of the publication, I will also suggest that you give a vote for the Internet currency that you personally prefer.

In Russia, there are several leading payment systems, but I think it is unlikely to arrange them to their strict places. In each case, you will need to choose exactly for your needs. For example, Kiwi in truth is a “people's” system and everyone who knows what payment terminals are working with it. At the same time, WebMoney is used by almost everyone who makes money in the Russian-language part of the runet. Yandex Money and other e-wallets have their own audience. But first things first.

If the main complaints about working with Qiwi (and many other systems) relate to the work of their technical support service, then the main problem in the WebMoney payment system is. Personally, I decided for myself that this problem does not allow making a single payment or authorization on websites without confirming this action on my mobile phone (a confirmation code comes in the form of SMS, or you put a special application on the phone to generate it).

Also, the safety and security of this electronic money depends. There are several of them, and I wrote about some of them in my time:

You also need to understand that there are various online currencies that are in circulation within this system. Currencies, of course, conditional (in fact, they are just title units), but rigidly tied to the official exchange rate of the real currencies that coincide with them.

The main ones, of course, are dollars (WMZ) and rubles (WMR), but they also have circulation and the euro (WME), hryvnia (WMU), Belarusian rubles (WMB), etc. In this connection, it is often necessary. About the most profitable ways of this action, read the article.

Personally, this system attracts me by the fact that you can bind a plastic card to your wallet, so that later you can use it to pay in the store and in all other places where MasterCard is accepted. In this case, an account on an electronic wallet is equal to the balance on the card and no interest is charged for its use (a fee is charged only when withdrawing money from an ATM). In my opinion, a very convenient way to withdraw the pennies earned on the Internet.

This payment system allows you to enter and withdraw funds in a variety of ways, as well as pay for many services and products. There is an application for a mobile phone that allows you to conveniently work with your electronic wallet without having to download a browser. In general, read this article.

P.S. Actually, each of you probably has his own subjective opinion about the services described above, so I suggest you take part in the voting for the best payment system of the RuNet:

Previously, it was rather inconvenient to withdraw money from Adsens, but after connecting Rapida everything was just fine (though only for residents of Russia). The fact is that in the Rapida system, you can set up payment templates for the transit of electronic money from Adsense to any convenient for you terminal payment options. Moreover, the templates are executed automatically when a payment is received from the context system of Google.

Payza (Alertpay) is another anonymous Internet payment system, in which anyone can open an account. This company was formed recently due to the merger of Alertpay and another similar system. Funds are deposited into the account by linking a bank card to it.

The main and runet can consist in receiving the Internet money earned abroad, their withdrawal or transfer to another user of this system. There is a problem with the withdrawal in the post-Soviet space, but it is completely solvable. I will describe in more detail in the review of these e.dedeg, which will appear, I hope, in a short time.

P.S. Well, the conclusion I suggest you express your opinion on the international electronic payment systems available on the market:

Good luck to you! See you soon on the blog site pages.

To send

Class

Lynch

Kick it

The main types of payment systems differ in the client's money transfer schemes:

Credit scheme As a rule, card payment systems belong to this type. A feature of this type of payment systems is the presence of a card regulator ( VISA, Mastercard, Maestro, Delta etc.) during payment processing. In a nutshell, the funds are transferred to the merchant account, and the processing center is responsible for their transaction and processing of card data.

If your business needs a connection to a card payment system, the first thing to do is to contact the processing center, not the bank. There are several reasons for this:

Debit scheme. This type includes payment systems that use digital equivalents of checks. By their functions, electronic checks are no different from ordinary ones: this is still proof of the right to receive money. The only difference is the electronic form of the check and the availability of a digital signature.

The process of making such a payment looks like this:

E-wallet system. When connecting to this system, all bureaucratic problems disappear, since each separate system combines the work of several types of organizations: responsibility, control, conditions of the payment processing process depend on the payment system itself. Although there are certain laws governing the activities of payment systems, for the implementation of cashless payments, this type is the simplest.

The e-wallet system includes QIWI, Webmoney, Perfect money, Paypal, Okpay, Paxum etc.

In addition, it should be mentioned that some electronic payment systems (for example, Paypal and Moneybookers), offer intermediary services in accepting payments. In this case, the payment system will take money from customers into its account, and then send it to you. This can be used if you have problems concluding an agreement with banks or you just want to save time. But it should be borne in mind that when using such a service, rather high commissions are usually charged, which can be equated to the cost of services of a good processing center.

All types of payment systems in practice have their own advantages and disadvantages. When choosing a payment method for your online service, you should consider which type of payment system your target audience chooses to pay for goods and services on the Internet, and it is better to create several payment options to reach a wider audience.

Using a variety of payment systems becomes even more enjoyable when there are no problems with their exchange.!

Hello! Today we talk about electronic payment systems. I will tell why they are needed and what they are.

Virtual payment systems are designed to pay for services via the Internet. Because money is transferred to the account quickly, the way is used by large companies, mobile operators, banks, etc.

Under the payment scheme, they are divided into:

In the vocabulary of economists and ordinary Internet users, the term “ Electronic money"Or" EPS". The system rotates not cash, but virtual currency. People quickly transfer this money on the Web from one purse to another. If desired, each person at any time can exchange electronic finance for cash and non-cash funds.

Payment systems on the Internet have become commonplace. They are especially popular among those who for work or for entertainment spends time on the Web.

Using electronic payment systems, a person receives the following benefits:

But there are a number of disadvantages, because of which many people do not trust virtual currency:

Using

Almost all virtual payment systems work in the same way. To start using any of them, you need to register and create a wallet.

Choosing "payment", you should be guided by its capabilities, so that it fully satisfies your needs.

Most popular Electronic payment system in Russian-speaking countries are considered:

Registration is always free. After it, you should understand exactly how you will receive money for the wallet. One of the common options is to give his number to the employer.

When buying goods or paying for services, you need to replenish your wallets with paper bills. This can be done through:

Registering in the electronic system, you need to enter only the data that correspond to reality. If necessary, technical support will require personal information from the user. When the account holder cannot present an identity card, his wallet may be blocked.

Now you know all the theoretical foundations about payment systems. Decide for yourself which one you will use. It is recommended to register at once in several and look at the advantages of each of the systems.

Subscribe to blog updates, profit to you!

Most Internet users actively use virtual payment systems. Electronic money is suitable for instant payment transactions in the system from your wallet and many replace bank cards or accounts. There are a large number of Russian and foreign online systems with which you can easily pay for purchases, receive money transfers and more. Before you begin to use virtual cash, it is worth exploring the features of different services.

Not every Russian is familiar with the concept of virtual money and the possibilities for using it. It is worth noting that this type of replacement of rubles or foreign currency differs from coins and banknotes in that their owner keeps them in a separate “virtual” resource. Electronic money is liabilitieswhich are taken by the issuing organization, in the form of funds held by the user, stored on an online resource. This segment is part of the virtual payment systems market.

The definition refers to a transaction, it is performed through digital communications. User virtual money can be debit or credit. They are not traditional money in the generally accepted currency, but are means of payment, certificates or checks (this may depend on the rules of the law and the specific EPS). The functions of the settlement instruments do not differ from the coins or notes issued by the Central Bank.

Modern cash systems such payment instruments are perceived as money that can not be exchanged, have a credit basis, are used for calculations, circulation, accumulation, have a certain level of reliability. Virtual money has the following characteristics:

Virtual money properties are based on traditional and relatively new:

The phenomenon of virtual money began to be studied by financial organizations since 1993. Initially, prepaid plastic cards were considered electronic means of payment. As a result of the analysis, virtual cash acquired legal status in 1994. Studying the technological schemes of using prepaid cards, banks decided that the distribution of such payment systems would require constant monitoring of their development and changes. This is to preserve the integrity of the products.

Since 1993, the active development of virtual money began, not only on the basis of smart cards, but also based on networks. Three years later, the central banks of Europe decided to monitor EPS in different countries. After this, the analysis of the development of virtual money has become a traditional process. Initially, the monitoring data were confidential, but since 2000 they have been shared. At the moment, residents of 37 countries constantly or periodically use virtual money.

On the territory of the Russian Federation, over the course of 13 years, online money has evolved from magnetic plastic cards, which were issued by individual organizations, to global Internet systems. Already in 1993, the Russians began to use the first similar funds. Approximately the same period dates from the first mentions in the press about money on the basis of smart cards. Until 1999, the payment systems are actively developing displacing banking products from the market. In the 2000s, they began to use electronic money on the basis of networks.

As a rule, the following classifications apply to any virtual money:

![]()

On Russian territory The most popular are the following payment systems:

This type of digital money consists of plastic carriers with a microprocessor, on which the equivalent of the value paid by the client to the initial organization-issuer is recorded. Cards are issued by banks or non-banking organizations. With the help of plastic, the client can pay for purchases and services at all points of reception of such a payment instrument. Cards are issued multi-purpose or branded (telephone, for example). The tool is suitable for making a payment transaction or cash out at an ATM.

Among the variety of plastic cards, there are two types: debit (for storage of own funds, savings, settlements) and credit (the plastic owner spends money within a certain limit, which the issuing organization will then have to reimburse). A popular version of smart card-based digital cash is VisaCash and Mondex payment systems products.

To use this option of cash, the user needs to install a special program on his smartphone or computer. Money is suitable for purchases in online stores, virtual casinos, games and other operations. They are multipurpose and are accepted not only by organizations issuers, but also by other companies. Among most famous electronic payment systems based on networks can be distinguished: Yandex.Money, Webmoney, Cybercash, Rupay. This type of service has a high level of security.

There is another classification of virtual money. They are subdivided into fiat and non-fiat. The first type includes the currency of a particular country, expressed in national currency. Issue, circulation, cashing and conversion of fiat money is provided for by state legislation. The second option is a currency emitted by a non-state payment system. Government agencies of different countries control the issuance and circulation of non-fiat moneyto a certain extent. This option refers to a variety of credit money.

Since September 2011, electronic payment systems are controlled by federal law No. 161. It reflects all the requirements for issuing organizations and conducting cash transactions. Previously, this industry was controlled by different laws, but with the entry into force of the project “On the National Payment System” it became a single document regulating the relations of the parties.

From a legal point of view, electronic money is the issuer's unlimited obligations to users of payment systems. The issue of cash is carried out as a credit limit or amount of liabilities. Circulation of virtual money is performed by assigning the right to the issuer. Accounting is carried out using special software or electronic devices.As for the material form of virtual money, it is information that is available to users around the clock.

The economic status of virtual money is a payment instrument that possesses the properties of traditional means or payment instruments, depending on the chosen method of implementation. With cash, virtual currency is united by the fact that users can make payments without using banking systems. With traditional payment instruments, electronic money is similar to the fact that a client can transfer an amount or make a payment without opening an account with financial institutions.

As a rule, electronic money is used in the online business. Treat this payment instrument as a form of market economy.With the help of virtual money you can make payments between customers and companies, while avoiding a large number of unnecessary costs or loss of time. Due to the technical component, electronic payments are carried out instantly, which distinguishes this method from banking operations.

One of the reasons why Russians are starting to use electronic money systems is the ability to instantly make a payment via the Internet. The service is available around the clock. You can send money to any other accounts using the details of organizations, individuals, other wallets, in the form of payments for utility services or cellular communications and so on. All transactions are saved by the system and monitored.Instead of the traditional client's signature, EDS is used - the most reliable way to protect user funds.

Another option for using virtual cash is credit cards. With the help of a physical plastic carrier, the owner of an electronic wallet can spend virtual savings when paying for purchases in supermarkets, hotels, and wherever bank cards are accepted. However, in this case, it is important not to transfer personal data to third parties in order not to lose money. It is especially dangerous to keep the details of such cards in online stores.

Fast service terminals and ATMs are another convenient way to use your virtual savings. To get cash, you need to issue an online card in the payment system. with bank details, but without a physical carrier. It is issued instantly and allows you not only to receive cash through ATMs, but also to pay for purchases on the Internet. Using bank terminals, users can not only withdraw money from virtual wallets, but also replenish online accounts.

In order to get cash in the cash offices of financial institutions, you can consider this option of using electronic savings, like issuing bank checks. In this case there are several ways:

Each system has its own principles of operation. As a rule, the founders of such non-bank payment services enter their digital currency (Bitcoin, DigiCash, WebMoney, letters of credit, certificates, E-Gold). The fact is that it is illegal to consider electronic money in rubles or dollars. Users actually can only hope that EPS will take care of its reputationbecause there are no legislative guarantees completely.

The principles of operation of different payment systems are similar. The founders issue their own currency, after which a cloud financial structure is organized, which includes the following:

To create an online wallet, the user needs to fill out a questionnaire, specifying personal data and phone number. It is worth noting that the client initially receives anonymous access to payments in the system, so passport data are often not checked. However, to go to a higher level and gain access to all the capabilities of the system, you need to go through identification. Additionally you can tie your bank card to your wallet. This option is not provided by the PayPal service, but the service is available in Yandex.Money or WebMoney payment systems.

The procedure for using electronic storage includes the following steps:

If receipt and expenditure transactions with e-wallets are easy to carry out directly through the site, then cash-out of available money requires the help of a financial institution or an ATM. Withdrawals are made to the account, card or mobile client by requisites.In addition, the use of points of payment is allowed. In this case, the user must transfer money to his wallet and get a password for cash out.

As a rule, the client needs to:

Modern users who do not know how to withdraw money from an electronic wallet can apply one of the following methods:

The use of online systems has its own advantages and disadvantages.Before you start a virtual wallet, you should familiarize yourself with them. Among the most important advantages are the following:

Among the disadvantages of using EPS, the following should be noted:

| Related articles: | |

|

Useful programs for easy printing

The presence in the arsenal of home appliances, along with a computer, is also a printer ... Mutton Soup with Potatoes

Mutton broth is not easy to boil, and not everyone loves this ... Types of payment systems: which one is better for online business

Electronic cash is digital cash in electronic cash. | |