Reader's Choice

Popular articles

The fact that every owner of a vehicle registered in Russia must systematically pay the corresponding tax is stated in the Tax Code of the Russian Federation. The only exceptions are preferential categories of individuals and legal entities for which a mandatory fee can be canceled. Before paying the fee, you should know how to calculate the transport tax. If the owner for some reason does not use his own car, it must be removed from the state register.

How is the vehicle tax charged? The state charges it with any types of self-propelled vehicles equipped with an engine (cars, motorcycles, yachts, helicopters). The calculation is carried out on the basis of the number of horsepower of the car. If in the transport after registration they changed the engine to a more or less powerful one, the owner must notify the traffic police located at the place of registration of the vehicle. Employees of the body will make the relevant data in the technical passport of the machine. To calculate the tax on the car, except for capacity, you need to know:

How to calculate the transport tax to citizens of Russia? According to current legislation, for individuals, the tax inspectorate calculates the rate directly. The Russians should independently submit to the body information about the purchase of cars, other self-propelled means. Transport tax rates for individuals and organizations are the same. The only exceptions are benefits provided for certain categories of institutions and citizens.

Transport tax is obligatory not only for citizens of the Russian Federation, but also for legal entities. Institutions make payments to the regional budget at the place of their location (registration). A feature of the transport fee for legal entities is the independent calculation of the amount of duty. Since this fee relates to the expenses of the organization, applying the taxation scheme “income minus expenses”, it is possible to reduce the single tax deducted by the legal entity at its expense. If the amount of transport duty exceeded the obligation, you can not pay a single fee.

To calculate the tax on a car, it is necessary to take into account the current rate (depending on the power of the car), the tax base and the reporting period (full 12 months). Regional regulations may provide for certain factors that should be considered in the calculations. They help to adjust the tariff depending on age, the price of transport, the category of the owner of the car. Some beneficiaries are generally exempt from paying transport tax.

In addition to the annual fee payment, legal entities can make advance payments within 12 months of the reporting period. After their sum is subtracted from the main collection amount. As a rule, the advance payment is of the total fee. Organizations annually file a transport tax declaration into the national insurance fund. In the same place legal persons can carry out the calculation of the insurance policy. The declaration form regularly undergoes some changes that can be tracked on the official website of the national insurance fund.

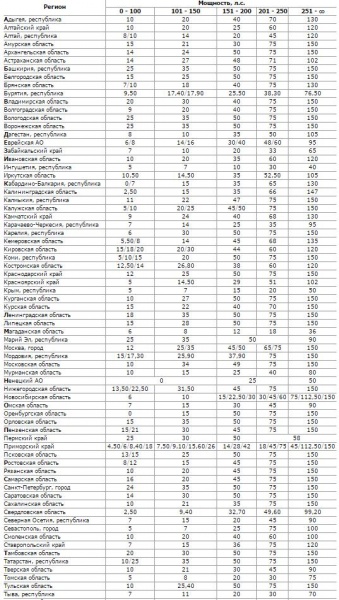

Since this type of tax charge is regional, the rates of different regions may vary. Despite the fact that the amount of fees is set and adjusted by individual subjects of Russia, the state sets a tax rate limit. Thus, the transport duties fixed in the regions may be more or less than the established state limit, but not more than ten times.

Taxation in Russia occurs for each type of transport separately. Regions have the right to apply the established or change rates. In addition, differentiated duty rates may be used locally, varying according to some factors (type, age, class of transport). In 2017, the Russian government did not increase the tax on transport, so the rates remained almost unchanged. Below is a table of new rates of transport collection for some cities of Russia.

To understand how much to pay for transport, you need to multiply the current rate on the power of the machine, expressed in horsepower. In addition, the calculation will need the age of the car. It is calculated from the year of release to the present. For example, if a car was released in January 2013, then in January 2017 it will be 2 years old. If the machine is owned by an incomplete year, use a reduction factor. To determine it, the number of months of owning a car is divided into 12 months. Example: 6: 12 = 0.5.

The price of the vehicle is also taken into account. On the website of the Ministry of Industrial Trade of the Russian Federation published a list of cars whose value is more than 3 million rubles. This list is updated annually until March 1. According to the latest news, the Ministry of Industry and Trade will henceforth independently monitor the prices of vehicles, in order to avoid fraud by unscrupulous car owners who deliberately underestimate the indicator. The general formula for calculating the amount of vehicle tax is as follows: tax base * car capacity * tenure.

Kuznetsov owns a VAZ Priora car registered in Voronezh. Engine power is equal to 98 horsepower. Having opened the table of tax rates in this area, we will see that with Priors up to 100 hp, the figure is 20 rubles. In this case, the size of the transport tax, which must be repaid by Kuznetsov, will be equal to: 20 p. * 98 hp = 1960 p. in year.

For individuals, the deadline for payment of the transport fee is no later than December 31 of the reporting year. If the owner plans to do a re-registration or undergo a vehicle inspection, it is better to pay a transport fee in advance. Different regions can set their reporting periods that differ from generally accepted, if there are good reasons.

As a rule, four periods are provided for legal entities: 1 tax (12 months) and 3 reporting (quarters). After each one is closed, organizations must make tax payments. If the institution repays the amount in parts on a quarterly basis - this is considered to be an advance payment (and there is no need to submit reports for quarters). In addition, you can make the full amount of the fee at the end of the calendar year. The declaration is completed once, at the end of last year.

The counter for determining the amount of tax on transport is convenient in that it allows you to calculate the exact figure payable. According to federal law, there are basic rates that are taken into account when calculating the amount of duty. You can find such online calculators on the websites nalog.ru, uslugi.ru and others. In addition, there is an opportunity to calculate insurance OSAGO and calculate the cost of hull insurance. After watching the video, you will learn how to properly use online calculators.

When buying a car you need to remember what awaits you in the future. The newly minted car owners only vaguely guess about the upcoming spending. The most unexpected for many is the need to pay transport tax annually.

You need to understand that after putting your car on the account in the traffic police, you become taxpayers and must pay for it in a timely manner. In case of late payment of transport tax, you will be charged a fine. Its amount will be 20% of the debt.

Important! Anyone who puts a new vehicle on the account in the traffic police should be remembered that since May 2014, employees of the state traffic police should not transmit information to the tax office. Now this responsibility falls on the shoulders of the car owners themselves.

There are hardly any people who want to pay taxes, for which everyone will find many excuses. But to be able to legally withdraw from their payment, it is necessary to understand the taxation mechanism itself.

First, let's figure out what parameters it depends on. There are only two of them:

Power affects the amount of vehicle tax in the most direct way - the amount of horsepower in the engine and the amount of payments accrued. Each region of residence has the right, according to federal law, to raise or lower the statutory rates for 1 l. with. using coefficients. Therefore, the generally accepted calculation is already taking into account these factors, and when they say "tax rate", they mean the rate itself, multiplied by the coefficient of a particular region.

Second, consider the tax rates for individual regions. In some of them it is possible not to pay transport tax if the car is not more powerful than 100 or 150 horsepower. For 2016, the rates look like this:

The first opportunity to legally get away from this item of expenditure is to buy a low-powered car in one of the regions of the country. Each region independently decides how much horsepower is not taxed in 2016. If you live in the Kabardino-Balkarian Republic, your car is less than 10 years old and the engine is not more powerful than 100 liters. c - you will not pay transport tax. Also, residents of the Orenburg region, owning cars with a capacity of up to 100 liters. with., exempt from payments. More lucky to everyone who lives in the Nenets Autonomous District. These people are exempt from paying taxes on cars with a capacity of up to 150 horsepower. Also sparing tax rates for engines up to 100 liters. with in the Sverdlovsk and Kaliningrad regions - 2.5 rubles per liter. with.

Also in the Russian Federation there is a list of vehicles that are not taxable:

The third option is not to pay transport tax - to register it on an individual who is exempted from these payments. In the Russian Federation to such relate.

Motorists independently calculate what kind of 150 horses they have to pay, and already from the service they receive an annual receipt according to the calculations. for this type of transport with the specified capacity is specified in the Tax Code.

According to the 28th chapter of the second part of the Tax Code of the Russian Federation, 150 hp are required. individuals and organizations that own such cars: cars, buses and other self-propelled cars and tracked and pneumatic gears, helicopters, airplanes, ships, sailing ships, yachts, boats, snowmobiles, snowmobiles, motorboats, non-propelled (towed vessels) hydrocycles, and other air and water vehicles that have been registered in accordance with the law.

The calculation of the tax on the vehicle for 2017, which is paid in 2018, you can use. In addition, you can independently calculate the taxation on the auto.

Cars are not subject to taxation:

The owner of the vehicle with more than 150 hp obliged to pay the tax, even if it was not in operation or in those. repair. In order to get rid of this obligation, one should remove the vehicle from the state registration.

Article 362 of the tax code provides clear explanations of how much a tax on a car is 150 liters. with. Taxation is made by the tax authorities, and all information should be provided to them immediately after passing the registration in the traffic police of the vehicle by the traffic police officers themselves.

Payment is made when the car tax comes in the form of a notification letter. This was valid until 02.05.2014. People who acquired the Federal Law No. 52 of the Customs Union after the entry into force, which introduces changes to the relevant chapters of the code, will have to submit information to the tax inspectorate at the place of residence.

If you do not do this, they will not receive a notification, failure to pay tax is punished by the amount owed by a 20% fine. Tax information must be provided exactly before December 31, 2016, if the vehicle was acquired in May 2015, i.e., before the end of the year with the past tax period.

It is easy to clarify whether a car is listed for the property for which a vehicle tax should be levied; you can find out on the FTS website. This is confidential information, so for an organization to access your personal account you will need to visit the tax inspectorate at the place of registration, taking with you your passport and TIN. There, a citizen will be registered in the database and given a login and password to the official page with personal data.

About when payments of the transport tax are made is also notified. Depending on the region, registered letters of notice to car owners can be sent at different times, but as a general rule, not earlier than November.

That is, the taxation for 2016 the citizen will have to pay after the occurrence of November 1, 2017. Sending a letter no earlier than 30 days before. The tax period is 1 year.

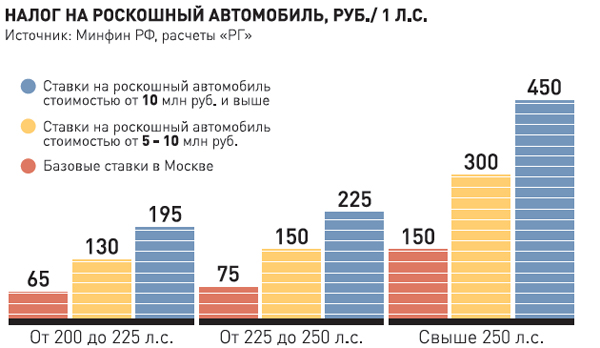

Taxes on expensive cars with more than 150 horsepower and cost from 3 million rubles are charged with an additional incremental ratio.

Under which cars you get, you can find out on the official list of the Ministry of Industry and Trade. The list increased by 1.5 times compared to 2016 due to the increase in the cost of foreign cars and the fall of the ruble exchange rate. There are already 279 vehicle models already there:

It can be easily determined that the older a car is, the smaller the multiplying factor will be, and there will be less payment when calculating the vehicle tax.

Most motorists, especially owners of luxury models with a lot of power under the hood, as well as other motorists with powerful cars from 150 hp. They want to avoid paying taxes. Legal methods for the first category have virtually no benefits, and owners of relatively inexpensive vehicles can, according to the law, determine and apply for benefits. Legal and common methods are:

It is easy to calculate the value of the transport tax, knowing the rate in your own region. If you don’t receive letters from the tax office for a long time, you should not expect penalties to be accrued - therefore, contact the local inspectorate, as for savings of 10,000 rubles, you can face restrictions on border crossings and other problems.

| Related articles: | |

|

Annual tax on cars

That each owner of the vehicle, ... Methods for the study of heredity in humans

1. Genealogical Genealogical method is to analyze ... Cauliflower puree soup with vegetables and cream

Today on our site is a recipe for cream of cauliflower soup with cream and ... | |